|

Dear Reader,

The Market.

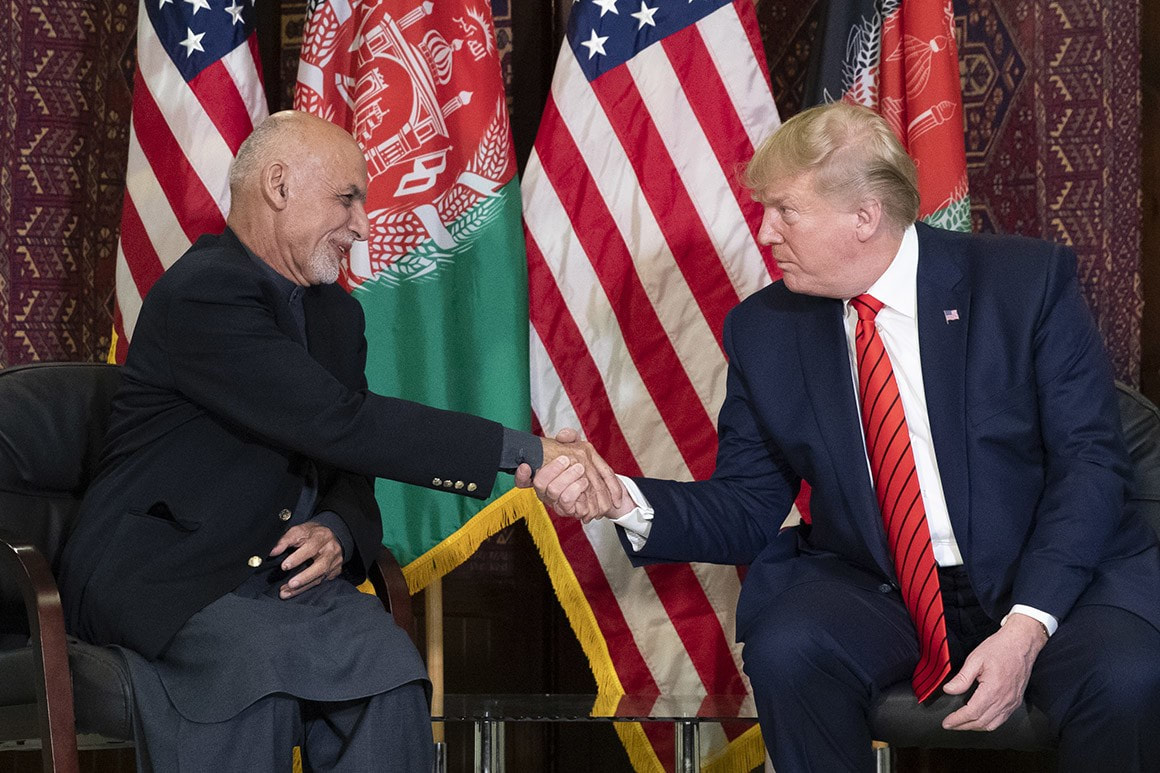

Technical Analysis. The best technical analysis consists of looking at the trends coming from monthly indicator charts. Is technical analysis a great way to base your investment decisions on? The graph below shows a similarity between Caterpillar and the Nikkei Index for a span of 5 years. Does it mean anything? You should base your investments on multiple analyses: technical, fundamental, comparative, and macro. The Bulls are Charging. Investor sentiment is at an extreme high, with all market indexes hitting new highs. Investors are heavily invested in equity while holding the lowest cash reserves. With low levels of cash reserves and extreme investor confidence, how much longer can the markets sustain new highs? Key indicators to look at are manufacturing, consumer confidence, consumer spending, GDP growth, household-debt-to-GDP ratio, new home sales and the number of new homes being built. If we see a slowdown in any of these, it’s a bearish sign. Besides these economic indicators, the 2020 elections, the Feds hiking/cutting/holding interest rates, the slowing of the Chinese and US economy, and the US-China trade war are the events that will be dictating the direction of markets. Based on banking sentiments, cyclical stocks, emerging markets, and economically-sensitive sectors like financials, industrials, and materials will be good plays if the market continues to go up. If not, look for hedges in assets like TIPS, REITS, Treasury bills, VIX, and defensive stocks like consumer staples and utilities. The Superiority of Investment Companies and Asset Classes. The comparison of the Vanguard Growth Index Fund ETF (VUG) and the Fidelity Growth Company mutual fund (FDGRX) is done to show how the difference in asset type, asset allocation, investment company reputation, and expense ratio influence fund performance. VUG is a Vanguard large-cap growth ETF with $95 billion net assets, the inception date of 2004, Beta of 1.04, an expense ratio of 0.04%, and a 1-year return of ~21%. This ETF is made up of large market cap US growth companies, with its top holdings being Microsoft (8.52%), Apple (7.87%), Amazon (5.81%), Facebook (3.59%), and Alphabet (2.93%). FDGRX is a Fidelity large-cap growth mutual fund with $41 billion net assets, the inception date of 1983, Beta of 1.20, an expense ratio of 0.85%, and a 1-year return of ~16%. This mutual fund is made up of large market cap US growth companies, with its top holdings being Amazon (6.44%), Apple (5.41%), NVIDIA (4.95%), Microsoft (4.37%), and Alphabet (3.93%). Now from a basic analysis, we can make the hypothesis of: because the Vanguard fund is more well known, has a lower expense ratio, has a lower Beta (lower riskiness), is an ETF (not a mutual fund), and has allocated their fund by buying more heavily into Microsoft, Apple, and Amazon (higher returning equities), they outperformed Fidelity’s mutual fund. China's Slowdown. China just posted its third straight month of declines in its industrial profits, being down 9.9% in October, over last October. This marks the steepest declines in industrial profits since 2011, most of which can be accounted for by severe overcapacity, with a lack of demand in the international economy, brought on by a harsh trade war. China, being the second-largest economy, has been in a trade war with the US, the largest economy, over the past year. Industrial profits have been falling severely for the last 6 months, with their equity market following suit, with fears of a looming global slowdown. With declines in industrial profits, China has been able to slightly offset this decline through growths in the mining sector, as-well-as utilities. This offset has not been enough to increase GDP growth past their historical growth, sitting currently at 6% over the last year. This overcapacity has led to decreases in raw materials, and final product prices, shown by a decrease in PPI (Producer Price Index). Political Talks. Valuation at its Finest. You may have heard about how certain companies are overvalued, undervalued, “a great buy right now”, “stay away at this price level”, etc. Analysts from Goldman Sachs, J.P. Morgan, Morgan Stanley, Credit Suisse and the like make a living telling investors what to do. This is all great, except by the time you hear about the investment opportunity from them, it’s already too late. In a way, it’s almost a self-fulfilling prophecy. An analyst puts out an article saying how this stock is a great buy, expected to increase by 20% in the next year, etc. Everyday retail investors see this and then race to buy the stock before they miss out. All of these people buying the stock causes the price to increase (pumping or dumping), which then fulfills the prediction originally set out in the article. As you can see, the stock price is often shot up without a true dive into financials. This leaves us a higher price, with less evidence to back it up and renders it more prone to a drop. (Example: when LVMH Moet Hennessy made an offer to acquire Tiffany & Co., TIF jumped ~50%. Example #2: recently, Morgan Stanley downgraded Dollar Tree, Inc. When a big bank downgrades a company, it can cause a selloff of that equity.)The key to investing is to know when a drop is coming, and when a stock is about to soar. How do you do this? You have to use at least one valuation method. The most popular being Discounted Cash Flow; this involves projecting the Free Cash Flow (the money after all cash expenses to be distributed) into the future. Once you reach a certain point, it makes sense to stop projecting the annual cash flows and come to a terminal value (the value of a firm in that year for all the years going forward). After all of this is done, you must discount all cash flows and the terminal value back to the present day. This is the #1 rule of finance. Money today is worth more than money tomorrow. You must always account for it. The basic formula for Free Cash Flow is “Operating Cash Flow – Capital Expenditures – the annual net change in working capital. Discounting all the cashback to the present day will give you Enterprise Value. Enterprise value is the true amount you would have to pay to acquire the firm. For instance, if I were to buy a company outright, I would not only be acquiring all the operations, but I would be acquiring all the debt that the company owed which I would now have to pay off. Similarly, I would also be acquiring all the cash the company has. This leaves us with the formula: Enterprise Value + Debt – Cash = Market Capitalization. Take the market capitalization and divide by shares outstanding to get a true value for a single share of stock. You may be wondering, “If it’s all based on the numbers, why do people come to different values?” The answer is that the numbers require reasonable assumptions to be made. Things like sales growth, research costs, etc. The skill of an equity analyst lays in their ability to make assumptions. That is what separates a fine analyst from a fantastic analyst. Keep Climbing, The Alchanati Campbell and Associates Team International Diplomacy: Diplomacy is defined in the oxford dictionary as the profession, activity, or skill of managing international relations, typically by a country’s representatives abroad. International Diplomacy takes many shapes around the world, depending on the country practicing and receiving such communications. All internationally recognized countries have a specific foreign ministry which oversees the diplomatic activities and exchanges that must happen in order to function in an international world. In the United States, this ministry is called the State Department, and is overseen by the Secretary of State. However, the Secretary himself reports to the President, therefore giving the President of the United States unusually direct power over the international relations of the United States. Resumption of Taliban negotiations: President Trump made a surprise trip to Bagram Air Force Base in Afghanistan this week, during which he announced the resumption of armistice talks with the Taliban, who is currently fighting both the Afghan government and NATO armed forces in an armed insurrection. An armistice would allow for the United States to disengage from the conflict while ensuring the stability of the war-torn country, as the Afghan conflict is now the longest military operation in US history. Talks were frozen several months ago when Taliban officials would not agree to President Trump’s demand that any signing ceremony happen at Camp David in the United States, and a subsequent suicide bombing in Afghanistan killed a US soldier. Engagement with the Taliban has been a hallmark achievement for the Trump administration, as previous administrations sought to avoid negotiations in order to maintain the legitimacy of the current Afghan government. The Taliban does not recognize this government and claims instead that it is a puppet organization of the United States. A successful armistice would allow President Trump to keep one of his most important campaign promises, and would continue with the current trend of disengaging the United States from many areas it had previously considered highly important to national security.

Dear Reader,

The Market.

Financial Fallacies. Like in literature, we have fallacies in finance as-well. A fallacy is a belief/observed occurrence which seems logical, but in reality, it is unfounded and unproven by statistics. Common fallacies present in finance/investing are the sunk cost fallacy, gamblers fallacy, loss aversion bias, confirmation bias, and the self-fulfilling prophecy. Although these all play a large part in day-to-day investment decisions, most people aren’t aware they exist. The sunk cost fallacy is continuing to include previously spent, irrevocable costs into your current investment decisions. An example of this would be investing in an equity, solely because you spent time researching it. Personally, I believe the fallacy which plays the largest part in the overall market would be the self-fulfilling prophecy. This fallacy states that because one believes something will happen, that will play a part in it actually happening. An example of this could be because a large portion of investors believe we will see a massive sell-off in this last q4 of 2019, as we saw in 2018, it will occur in large part to these investors selling in preparation. A World in Protest. Over the past year, we have covered the rise of authoritarian leaders and “strongmen” across the world, who rose to power in the wake of people's frustration with their standard of living. It appears this trend may be coming to an end. In the U.S over the last two waves of state elections, the citizens of the U.S have stood up to the current administration and elected a significant number of Democratic candidates. Over the past few weeks, mass protests have broken out in Bolivia, Chile, Spain, Ecuador, Lebanon, Hong Kong, Iraq, and Iran. While these protests are separated by thousands of miles and have different causes, the same themes still arise. Except for Hong Kong, all of these protests can be tied to income inequality. Income inequality is a disparity of income distribution which the majority of income going to a small percent of the population. Economists have found that countries with high-income inequality have high rates of health and social problems. The graph below will give you an idea of where some major countries measure income inequality. In Bolivia after a brief period of recovery where their president cut extreme poverty in half in just a few years, the people now face increasing rates of extreme poverty. Chile has one of the highest income inequality rates in the world. In Ecuador and Iran, government actions lead to an increase in the price of fuel that acted as a catalyst pushing thousands of people to protest the increase in fuel prices combined with a low standard of living. While the government of Ecuador has met the demands of the protesters, the government in Iran had reacted to protestors by shutting down the nation’s internet and shooting at protestors. There is no doubt that the core issue in these countries is income inequality. While most of these countries are rich in natural resources much of that wealth goes to a very small percent of the people, creating a very low standard of living leading to social and health problems and frustrating the people of these countries. With any luck, these protesters will continue their momentum and lead to at least some improvements in their countries, because a more equal economy is more productive and able to grow at a steady rate. Are you sure your investments are appropriate for you? High valuations or low valuations, overweight or underweight, bullish or bearish, growth or value, income or total returns, etc. are very important to consider when investing, but are not nearly as important as how the investments jibe with you personally. Here are some important factors to consider to help you judge the appropriateness of your investments:

Recommendations on How to Sustain Economic Growth. Output growth is strong, the tax reform has boosted business dynamism, inflation is moving up, unemployment is low, but regulations continue to hinder the business environment, infrastructure is under-supplied, participation remains low, and housing prices are high. What are the solutions to these problems? Incentivize corporations and consumers to spend more, raise interest rates at a gradual pace as long as inflation remains close to the Fed’s target, ease restrictions and regulations, remove exemptions from anti-trust law, reform housing finance and support the provision of affordable housing for low-income families. By solving these problems, we can help the economic expansion continue. Impeachment. While following this process, a group of elected officials seeks to accuse another public official of criminal wrongdoing. In the United States, impeachment does not actually result in the removal of said official, but rather a successful impeachment becomes a formalized accusation that is put forward from the US House of Representatives to the Senate, where the House acts as a “prosecutor” of sorts, seeking to prove to the Senate the guilt of the accused party. The Senate acts as a “jury,” and the proceedings are presided by the Chief Justice of the US Supreme court. Importantly, impeachment is not a criminal process and is largely political in nature. Impeachment Hearings to Date. On September 24, 2019, House Speaker Nancy Pelosi put forward a motion to initiate an impeachment inquiry into President Donald Trump as a result of testimony from a “whistleblower” from within the Trump administration. The whistleblower was responding to a phone call between the Ukrainian President, Volodymyr Zelensky, and President Donald Trump, alleging that the US President had withheld $400 million of American military aid from the Ukrainian government in order to pressure them to investigate former US Vice President, and possible presidential rival, Joe Biden. The impeachment inquiry began with a closed-door fact-finding session in the US intelligence committee, where both Democrats and Republicans interviewed potential witnesses for the upcoming impeachment proceedings. The next phase involves public hearings by witnesses that are called by both Democrats and Republicans, where both sides are permitted to ask questions. The first witnesses included members of the bureaucratic class of Washington, including Lt. Colonel Alexander Vindman, whose careers are meant to encompass multiple administrations and are therefore seen as generally impartial to partisan bias within their areas of expertise. The next witnesses called include officials specifically appointed by Donald Trump and would, therefore, be seen as potentially more loyal to the Trump administration. One of these witnesses, Ambassador to the EU Gordon Sondland, testified that he was instructed by his superiors to withhold aid from the Ukrainians in pursuit of the investigation of Vice President Biden. Mr. Sondland, a former hotel-magnate from the Pacific Northwest, was appointed by the President, and personally donated more than $1 million to the Trump campaign in 2016. Keep Climbing, The Alchanati Campbell and Associates Team Dear Reader,

The Market:

Public Equity Picks. Our team does NOT offer investment advice. We are in the business of educating and sharing knowledge; knowledge that will be more useful and valuable than the day-to-day headlines we all see in the newspapers and media. But our team is full of like-minded individuals and we all share a growing passion for finance and investing. We have many insights, but here are three of our insights regarding public investments:

CPI and Inflation. This week, the October consumer price index or CPI was released, showing a 0.4% increase over last month which was the largest gain since March. This is significant because the Federal Reserve uses the CPI along with the PCE and PPI to track inflation. The CPI is a measure that looks at the weighted average price of a basket of consumer goods and services that is calculated by the Bureau of Labor Statistics. By looking at the cost of household goods and services such as; food, transportation, medical care, and energy needs, the CPI can track the change in price and determine the buying power of the dollar. The reason the Fed uses other indices as well is that the CPI can be easily skewed by outliers in the data, which was exactly the case in October because energy prices rose 2.7% and are responsible for the majority of the 0.4% increase. The Fed targets 2% inflation measured by the PCE index as a guideline for underlying economic strength. October’s CPI brings the year on year basis to 1.7% showing that consumer inflation will likely be on target by the end of the year supporting Fed Chairman Jerome Powell’s resolution to hold rate hikes through the end of the year. Shiller PE Ratio. The Shiller PE ratio is a measure of the market valuation. Also known as Cyclically Adjusted PE Ratio (CAPE), it is aptly named after Professor Robert Shiller of Yale University; it is thought to be a more effective method of measurement than the commonly-used P/E ratio. This is due to the fact that the P/E ratio can vary widely depending on macroeconomic swings. Remember, in finance, measurements are all about consistency and stability. The goal of any measurement is to eliminate the fluke fluctuations and find the true number.Shiller PE uses earnings on an annual basis of the companies within an index, like the S&P, and adjusts for inflation (always, always adjust for inflation). Then, you simply average the earnings for the past ten years and the equation becomes the simple Price/Earnings that we all know and love. Right now, the Shiller PE is 30, far above the mean of 17. How do we utilize this information? Well, generally speaking, the lower the P/E the better, but it depends on the industry. Given that the Shiller P/E right now is much higher than the average, the assumption would be that now is not a good time to buy. That doesn't mean that if the market is soaring, you should never buy. Rather, it might be wise to be more strategic with your investment choices (companies). If the Shiller P/E was lower, now might be a good time to buy. As great as the Shiller P/E is, like any statistic, it is not an all-encompassing statistic. You need to look at other macro and microeconomic measures, as well as look into the past periods of economic expansion to see how the Shiller P/E behaved. Using past history and behavior, along with a plethora of current measures, you can be most assured of your beliefs. The Shiller P/E has been reliable in foreseeing the Great Depression, Black Monday, and the dot com bust when the ratio was over 40. In all those cases, the ratio showed that earnings can be going off the charts and the resulting impact on equity is not always so hot. While the ratio has its doubters, who believe that the high ratio should be mostly ignored due to the fact that by nature it only looks backward in time, it has continuously demonstrated its ability to at least sniff out the beginnings of a crash. Current Market Valuation. The S&P 500 is currently up over 23% YTD and the DOWJ is up about 20%. In the past, the S&P 500 has sat around a median 15 price/earnings, while currently its sitting north of 23. Although the price/earnings ratio has long been used to determine if an equity is under/overvalued in comparison to its counter-parties in its industry, some use it to determine how the overall market is valued. I personally believe the latter is changing quite fast. With the rise of globalization over the last 10 years and the ever-increasing importance of international trade, I believe the P/E ratio for stating the value of the overall market is becoming obsolete. I think we are heading towards a state where our market performs in comparison to how our economy is doing relative to other world economies. Although our economy is doing just OK in comparison to past years, relative to other global economies we are doing quite good. I believe this relative approach is what has given us this 23% gain over the last year and will continue to display gains into 2020 for the US capital markets. Political Bar Talk Freedom of Speech: Often referred to in the United States as one of the basic 1st Amendment guarantees, Freedom of Speech is a broad concept. Generally, it is known to encompass the freedom of individual and press organizations to express their opinions publicly without government censorship or retaliation. The most contentious form of speech in this context is usually political speech. The regulation, or lack thereof, or political speech can often be used as a barometer for how open or closed a society is. For instance, in the United States, statements in support or criticism of any sort of political cause or organization, so long as that statement does not cause or incite violence, is fully protected by the government. However, in countries such as the Russian Federation and the Peoples' Republic of China, statements, and protests made in criticism of the ruling party are often prosecuted with lengthy prison sentences and violent state action. Protests in Hong Kong: On Sunday, March 31, 2019, monumental protests began in the Chinese territory of Hong Kong to protest a proposed law that would allow the extradition of Hong Kong residents to mainland China who had been convicted of crimes that the Chinese government considered especially dangerous. While Hong Kong is technically part of China, it maintains a largely separate judicial system, allowing it to maintain transparent legal processes vital to sustaining international business. This bill would have significantly eroded the independence of Hong Kong and was seen as a breach of the “One Country, Two Systems” agreement China agreed to in 1997, which guaranteed an autonomous Hong Kong, including its citizens' democratic rights, until 2047. Protests to this bill have exploded in popularity within the territory, with over a quarter of local residents rumored to have participated in at least one protest. While organizers largely maintained peaceful demonstrations, frustration with a lack of progress on grievances, as well as aggression by police, has pushed certain elements of protestors towards extremism and violence. While the Chinese government has generally allowed local police to contain the protests, civil action of this scale has been crushed by the Chinese military in the past. The future of Hong Kong’s relative independence hangs in a precarious balance, and a Chinese state intervention would likely mean the end of the only semi-democratic enclave in China. Keep Climbing, The Alchanati Campbell and Associates Team Hello Readers,

My name is Alex Zabit, and I will be putting together the new politics section of your newsletter. As a recent graduate in Political Science from UCSB, I will do my best to translate the chaos of today’s ridiculous times into easily understood concepts that, through the course of my articles, will help you all have the tools to put events into context, parse through facts and fiction, and overall better understand and predict past, present, and future events. I truly hope you enjoy what I have put together for you. Cheers, Alex Z Political Bar Talk. It will be broken down into two sections. The first, I will be choosing an abstract political concept that many of you may feel like you understand the jist of, yet may find a hard time explaining to another person. If you may find yourself in a political argument in a bar, hopefully this will help. The second, I will be discussing a current event of particular importance to international security, economic health, or stability. This event will elaborate on a real world example of how the above concept is used, or misused, to the benefit or detriment of the individuals, communities, and government affected. The Market:

Why Our System is Broken According to Ray Dalio. Lenders are lending out tons of money because interest rates (the cost of borrowing) are very low, Central Banks continue to buy financial assets adding money to investor pockets, investors are choosing to invest the money instead of spending it and they are choosing to take losses on their investments (accepting very low or negative interest rates when lending their money), and money is being thrown at start-ups at alarming rates (even when these not profitable tech start-ups already have too much investor money). Money is “free” for those who have money and creditworthiness, but it is becoming expensive to borrow for those who do not have the required creditworthiness (consumers being charged 50-200% interest on their borrowed money). The government deficit will continue to grow which will require the government to increase their debt, interest rates will remain low even though raising rates would help the government control their debt levels, and the world has been overly leveraged for a long time. Pension and healthcare liability payments are at risk. Pension fund managers are finding it increasingly difficult to find substantial returns that can meet their pension fund obligations. The US healthcare system is unstable and becoming more expensive for consumers. The three options to be able to fund pension and healthcare obligations would be to cut their promised benefits, increase the money supply or by raising taxes. Signaling Theory. Signaling Theory is the idea that the actions of high-level executives and the companies they manage give signs as to how the company is performing and expecting to perform beyond the simple earnings report. It is most prevalent in dividends. When a company increases their dividend yield (the relative percentage of the stock price paid out to investors), it displays to the marketplace that the company is ok with retaining less of their earnings (the more dividends they pay, the less they keep). If a company is ok with retaining less of their earnings, it is likely because they know, or expect based on private information, that the company is performing well. That could mean more sales in a crucial area, a potential acquisition, a new product set to debut, and so much more. As a result, investors will buy more of the stock, because based on all the signs, the company is going to perform well in the earnings season. On the flip side, if a company decreases its dividend, it tells investors that the company can no longer afford to pay that much dividend, as it will eat into their decreased profits too much. In this case, investors will sell off the stock because, in their minds, not even the executives of the company have faith in their upcoming performance. In fact, signaling theory is so important that companies will actually take on new debt in order to keep paying out the same or higher dividend even if their revenue (and bottom line cash flow) is decreasing. The Economy and Equity Market. The economy, which has exhibited 1.9% GDP growth over the last 4 quarters, leads investors to believe the equity market, which has displayed over 22% growth since January 1st, will start a decline to follow suit. Although the economy and equity market usually follow each other, with the former acting as a quasi-leading indicator for the market, this is not always true. A professor from Chapman, Mark Skousen, put this best in one of his classes, and paraphrased from his book, “A Viennese Waltz Down Wall Street”, the market and economy can grow apart, like in the Viennese waltz, but will always come together at the end. In the current global atmosphere, we see a slowing global economy, with political fears present in China and the UK, leading capital to flow from these troubled countries to a relatively stable safe domain, the US. Although the US economy is showing just OK economic data, we are relatively doing better than most other countries. This relative point is what is leading the US markets to display what seems like irrational exuberance, in what looks like a faltering economy. As fears of a global slowdown grow, and sovereign debt continues to lead further into negative interest rates, we will continue this Viennese waltz, with the equity market making new heights, and the economy falling behind. Why it's Better to Put Bonds in Retirement Accounts. When it comes to investing, it’s not how much you make that matters- it’s how much you keep after taxes. As a general rule, investments that tend to lose less of their return to taxes are good candidates for taxable accounts. The best investments to hold in IRAs and 401ks are taxable bonds and taxable bond funds. Outside of a retirement account, they’d be taxed much higher than your stock funds. There are many different types of bonds: US Treasuries, corporate bonds, high-yield bonds, and municipal bonds. Investors may be able to realize significant tax benefits by including bonds in their portfolios. There are also many different types of retirement accounts, but the most well known are the IRAs and 401ks. The Roth IRA is funded with after-tax dollars and grows tax-exempt. Bonds are generally taxed at a higher rate than stocks. If bonds are not held in an IRA, income from them is taxed as ordinary income (the federal tax rate for ordinary income can be as high as 37%). IRAs are especially attractive for holding Treasury Inflation-Protected Securities. Since the income produced by bond funds is taxable, it is better to put them in a tax-exempt account. But it is important to avoid holding municipal bonds in an IRA. $2 Trillion. In the early 1930s, a relatively small oil company known as Standard Oil of California was seeking new sources of oil from abroad when it stuck oil on the Arabian mainland and received drilling rights from the government. Several years later, Texaco bought a 50% state in the arrangement and helped find vast amounts of oil. In 1944 the company name was changed to the Arabian American Oil Company or Aramco. Aramco would go on to become the world’s largest oil supplier and support U.S oil needs as U.S policies and wars limited oil sources. In the 1970s the Saudi Arabian government began to increase its interests in Aramco and eventually took over full control of Aramco through the Saudi Arabian Oil Company. Today, Aramco is believed to be the world’s most valuable company, worth somewhere between $1.2 and $2 trillion dollars and most likely holds the title of most profitable company with a reported $111.1 billion in net income for 2018. Aramco also has the second-largest proven oil reserves and second-largest daily oil production. With stats like this, their December IPO should be a breeze as investors fight over shares, but that does not seem to be the case. Aramco’s IPO comes at a time when many investors are beginning to turn away from oil. American investors remain skeptical towards the IPO largely due to its valuation. The Saudi government originally estimated Aramco to be worth $2 trillion dollars but then dropped their valuation to $1.7, but many analysts think that geopolitical factors need to be accounted for an estimate a valuation closer to $1.2 trillion. Aramco remains at the center of several multinational disputes and is often the target of attacks aimed towards the Saudi government or western influence. The recent September attack, for example, cut Aramco’s oil production in half, such an attack on a large public company would be devastating for shareholders. Investors have also made the point that the Saudi government may only sell 2% of Aramco which would give virtually no say to minority shareholders. As if these issues weren’t enough there are reports that Aramco’s finances are heavily entwined with the government’s, stating that its profits have been used to boost government budgets and even pay for government officials' luxurious accommodations, which is something many shareholders will not stand for. These issues have to lead the Saudi government to pressure rich Arabian families to commit to investing millions in order to ensure a successful IPO. The Saudi government has also turned to China, the world’s largest oil importer to commit to the IPO. China is expected to commit around $10 billion in an effort to hedge against rising oil prices and support its Belt and Road program. There are likely going to be many more updates on this as the company prepares for their IPO and the December OPEC meeting so we will be sure to keep our readers updated. Keep Climbing, The Alchanati Campbell and Associates Team Dear Reader,

Happiness. The world is so angry, it’s getting harder to enjoy the little pleasures in life. Satisfaction is a rarity because we always want more. Happiness is like privacy: hard to have. What makes you happy? Life begins and ends with happiness, but with the happiness of two kinds. The first joyful and excitable, and the second calm and resigned. We are always in a rush and most strive for perfection. Little disturbances, troubles, delays, occurrences, change our mood to a negative one. When we don’t get what we want, when we compare ourselves to others, when we have high expectations... it all puts pressure on our happiness. Our subjective well-being depends not on our absolute material well-being, not even where we stand relative to others, but on where we think we stand. One secret to happiness is to ignore comparisons with people who are more successful than you are: always compare downwards, not upwards. Happy people don’t put other people down. People are happier when they do generous things and live among generous people. Expect less and appreciate more. I give everything except for what I can lose forever. Enjoy every day as it comes. Who is rich? One who is satisfied with what they have. If you can concentrate always on the present, you’ll be a happy person. Know that no one is ever satisfied with where they are. The Market:

Why are companies paying fewer dividends or no dividends? A dividend is a distribution of a portion of a company’s earnings to holders of its stock. Dividends = meaningful portion of stock returns. When a company makes money, they have the option of distributing their retained earnings in the form of a dividend, retaining the earnings and using it to pay off debt or pay for R&D, or use it to buy back their stock. When a company pays dividends, its board of directors decides what percentage of its earnings to distribute to shareholders. Investors love dividends; over the last 100 years, half of the total stock returns came from dividends. Companies pay dividends to make their shareholders happy (making the company more appealing) and sometimes companies retain so much net profit that they’re able to pay dividends and still have money left over. But why do companies not pay dividends? Some companies use their retained earnings to fuel its growth, they choose to use the money and put that money to better use (Research and Development, Acquisitions, etc.), shareholders are taxed on the dividends they receive and some investors don’t want to pay extra taxes so companies choose not to distribute dividends, and companies that start to pay dividends, it can be difficult to stop so they are stuck paying dividend (investors see a drop in dividend payout yield as financial instability). Berkshire Hathaway, the company founded by Warren Buffett, is a well-known company that does not pay a dividend. The company prefers to reinvest profits in things that allow the company to improve its efficiency, expand its reach, create new products and services, and further separate themselves from the competition. Shareholder Yield by Meb Faber. This is a short research piece on capital allocation and investing. “Returns for shareholders will be determined largely by the decisions a CEO makes in choosing which tools to use in deploying capital and raising capital. Dividends and their reinvestment represent a major portion of a stock investor’s total return over time. Reinvested dividends represent over half of an investor’s annualized returns (over the period of 1871-2011). By reinvesting dividends and compounding the portfolio returns, the final value of the total return portfolio turns out to be 99.8% higher than the non-dividend portfolio. Dividends contribute virtually all of the final portfolio value versus a price only return. A study done by Elroy Dimson, Paul Marsh, and Mike Staunton showed that higher dividends yielding stocks outperformed low dividend-yielding stocks in 20 countries from 1975-2010. One of the most important qualities of a successful investment analyst is the ability to adapt to change. Companies have been lowering their dividend payout ratios for the past 70 years. One of the reasons for this is beginning in the late 1990s, share buybacks have outpaced dividend payments. The purpose of a company is the maximize long-term value.” Why dividends are important. Over the long term, the return from dividends has been a significant contributor to the total returns produced by equity securities. Portfolios consisting of higher dividend-yielding securities produce returns that are attractive relative to lower-yielding portfolios and to overall stock market returns over long measurement periods. Stocks with high and apparent sustainable dividend yields that are competitive with high-quality bond yields may be more resistant to a decline in price than lower-yielding securities because the stock is in effect “yield supported”. The ability to pay cash dividends is a positive factor in assessing the underlying health of a company and the quality of its earnings. The payment of dividends has been declining and the repurchase of shares has been increasing. The US Healthcare System. The United States spent $3.65 trillion on healthcare in 2018, more than any other country and more than the entire GDP of Brazil, the U.K, Spain, or Canada. At current rates, healthcare spending will increase to 20% of US GDP by 2027. This spending equals an average of $11,212 per person. Despite having some of the most advanced healthcare technologies in the world and spending these vast amounts of money, the U.S healthcare system is ranked 27th in the world. In the U.S, people are/were (healthcare and tax law has changed sporadically under the current administration) required to have health insurance to help offset the high costs of healthcare. Health insurance can be provided by the federal government, state government, or by private providers. Private providers generally offer either a Health Maintenance Organization (HMO) or a Preferred Provider Organization (PPO). HMO plans have lower monthly premiums, low or no annual deductible, require a primary care physician referral before seeing a specialist, and provide a list of network providers, but if you chose a provider outside of their network you will have to pay 100% of the cost. PPO plans offer more flexibility, allow you to see more out of network doctors, and are usually offered by employers to their employees. The federal and some state governments also offer health insurance to provide for lower-income individuals and families. Despite these options, healthcare costs are still devastating for the average family which is why in a recent poll 87% of voters in a recent poll say it is very important for a candidate to discuss healthcare. This overwhelming voter interest in the topic has led many of the presidential candidates to release healthcare plans. These plans all aim to lower the cost of healthcare and ensure all Americans are covered, but use different tactics, some candidates want to simply improve our capitalistic model, some want to socialize the entire healthcare system, and others think a mix between the two may offer the best solution. Whichever the strategy might be, these healthcare plans are going to cost a lot. This week Elizabeth Warren released her strategy to pay for the massive $20.5 trillion needed to pay for her proposed since-payer health care plan. This plan does not increase the cost of healthcare on the average taxpayer and will likely save the average family tens of thousands of dollars in the long run, but it boldly targets wealthy individuals and corporations to pay for the cost. Some argue that this tax burden will stunt economic growth, while others believe that in the long run strategies like this will improve the efficiency of the healthcare system allowing the economy to grow due to the potentially billions of dollars that consumers would save on healthcare and could use to increase their spending or investments. Whatever the outcome may be healthcare will continue to be a heavily debated topic of the upcoming election year. Americans’ Levels of Concern about Personal Finance. 1. Not having enough money for retirement. 2. Not being able to pay medical costs in the event of a serious illness or accident. 3. Not being able to pay medical costs for normal healthcare. 4. Not being able to maintain the standard of living you enjoy. 5. Not having enough money to pay for children’s college. 6. Not having enough to pay for normal monthly bills. 7. Not being able to pay your rent, mortgage or other housing costs. 8. Not being able to make the minimum payments on your credit cards. Online Installment Loans. Online installment loans are personal loans that borrowers can apply for online. The average borrower balance is $16,259, the interest rates are often extremely high starting in the double digits but can range from 34% to 200% and have much larger maturities. In recent years online installment loans have grown as subprime lenders shift from payday loans to offering online installment loans (lenders are targeting the middle working class). The volume of the number of installment loans approved has grown 8x since 2014. Keep Climbing, The Alchanati Campbell and Associates Team |

AuthorWHAT'S UP FRIDAY? is a weekly newsletter that will give you a summary of "What's up?" on Wall Street, in the US and around the World written by The Alchanati Campbell and Associates Team. What makes us unique is we focus on long-term knowledge; knowledge that will still be useful to you 10 years from now. Archives

July 2020

Categories |

|

Phone: (323)-553-2411

|

|

All information stated does not represent The ACA Foundation's opinions and we do not claim responsibility for most of the content. This website does not provide individual or customized legal, tax, accounting, or investment advise.

All Rights Reserved

All Rights Reserved

RSS Feed

RSS Feed