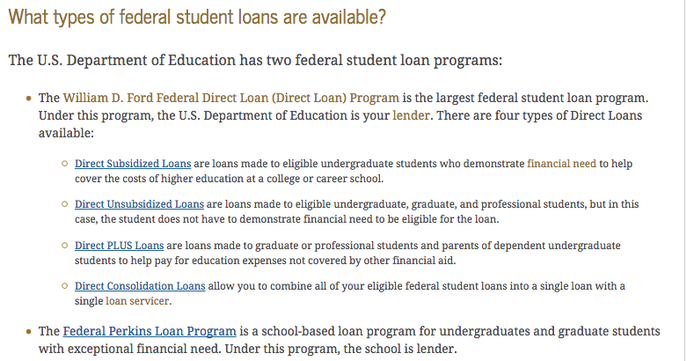

What is a Loan?Money you borrow with interest that you need to pay back. What are Student Loans?A type of loan designed to help students pay for schooling and expenses related to schooling. Two Types of Federal Student Loans

https://studentaid.ed.gov/sa/types/loans#types Tips On How to Pay Off Student Loans Faster

Common Mistakes

How to Avoid a Loan Scam1. Avoid Upfront Payments 2. Be Wary of Aggressive Sales Pitches 3. Don't Give Out Your Personal Info 4. Do Your Research Report being scammed to the CFPB, the Federal Trade Commission (FTC) and your state attorney general's office. ResourcesStudent Loan Refinancing and Consolidation Cheat Sheet

https://studentloanhero.com/student-loan-refinancing-cheat-sheet/?utm_source=automationemail&utm_medium=email&utm_campaign=refi-refiautomation&utm_content=ba-email1 Student Loans 101 https://myfedloan.org/borrowers/student-loans-101/ Is the Government Making Money off of Your Student Loans? http://money.cnn.com/2016/08/04/pf/college/federal-student-loan-profit/index.html?iid=EL Student Loan Basics https://www.discover.com/student-loans/college-planning/loans-101.html Don’t Be Fooled By Student Debt Relief Scams http://money.cnn.com/2016/08/16/pf/college/student-debt-relief-scams/index.html?iid=ELStudent Loan Refinancing and Consolidation Cheat Sheet https://studentloanhero.com/student-loan-refinancing-cheat-sheet/?utm_source=automationemail&utm_medium=email&utm_campaign=refi-refiautomation&utm_content=ba-email1 Student Loans 101 https://myfedloan.org/borrowers/student-loans-101/ Is the Government Making Money off of Your Student Loans? http://money.cnn.com/2016/08/04/pf/college/federal-student-loan-profit/index.html?iid=EL Student Loan Basics https://www.discover.com/student-loans/college-planning/loans-101.html Don’t Be Fooled By Student Debt Relief Scams http://money.cnn.com/2016/08/16/pf/college/student-debt-relief-scams/index.html?iid=EL

0 Comments

1. Don't think- know and act

2. Always be prepared so you have the freedom to act on instinct 3. Don't be motivated by money or anything external 4. Never be satisfied 5. Always be in control 6. Be true to yourself 7. Never let off the pressure 8. Don't be afraid of the consequences of failure 9. Don't compete with others. Make them compete with you 10. Never stop learning 11. Success isn't tough- it only increases the pressure 12. Don't get crushed by success 13. Completely own it when you screw up 14. Let your work speak for itself 15. Always work on your mental strength 16. Confidence is your greatest asset 17. Surround yourself with people who remind you of the future, not the past 18. Let things go, but never forget 19. Have clear goals 20. Respond immediately, rather than analyzing or stalling 21. Choose simplicity over complication 22. Never be jealous or envious of someone else's accomplishments 23. Take the shot every time 24. Don't think and act 10x 25. Don't get caught up in the results of your success. Always remain focused on what got you those results: the work. 26. Set goals that far exceed your current capabilities 27. Make time for recovery and rejuvenation 28. Start before you're ready 29. If you need permission, you probably shouldn't do it 30. Don't make exceptions 1. The ability to distinguish "temporarily out of favor" from "wrong".

2. The willingness to adapt views you wish were permanent. 3. The ability to be comfortable being miserable. 4. The ability to distinguish when analytics vs. psychology is necessary.

Economics has become a religion. It runs the world and it creates wealth for many. Here are seven different types of economic theories: Neoclassicists: Individuals as utility-maximizing algorithms; utility driven transactions. Keynesians: How to prevent recessions from turning into depressions in the short run; a fall in aggregate demand must be reversed through increased investment. Monetarists: Money supply should be the government's sole economic-policy tool and be used to maintain price stability through equilibrium of the money supply. Rational Expectations: Disagrees with Keynesians and Monetarists. People make choices based on rational outlook, available information, and past experiences. Austrian School Libertarians: The workings of the broad economy are the sum 0f smaller individual decisions and actions. Empiricists: Evidence-based; use data. Marxists: The specialization of the labor force coupled with a growing population, pushes wages down, and the value of goods and services does not accurately account for the true cost of labor.

Bonds are great conservative investments that offer lower, but more safe yields. But being more safe does not mean there is no risk. Here are five examples of bond risks: Interest rates and bond prices carry an inverse relationship- As interest rates fall, the price of bonds generally rise and vice versa. Reinvestment risk- Having to reinvest proceeds at a lower rate than the funds were previously earning. Inflation risk- If inflation increases dramatically, investors will see their purchasing power erode and may actually achieve a negative rate of return. Credit/Default risk- If the bonds (certificates of debt) are not repaid, then the investors lose their initial principle. Corporate bonds are not guaranteed by the full faith and credit of the US government. Liquidity risk- Risk that an investor might not be able to sell his corporate bonds quickly due to a thin market.

|

AuthorMy name is Camden Alchanati and my goal is to teach you how to create a future of financial stability and growth! Archives

June 2020

|

||||||

|

Phone: (323)-553-2411

|

|

All information stated does not represent The ACA Foundation's opinions and we do not claim responsibility for most of the content. This website does not provide individual or customized legal, tax, accounting, or investment advise.

All Rights Reserved

All Rights Reserved

RSS Feed

RSS Feed