|

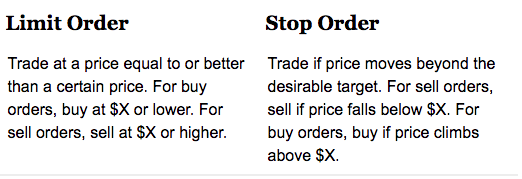

The selling stage is when profits or losses are determined. Buying sets the purchase price of how much you will gain or lose, but selling guarantees the gain or loss. Example: Say you buy 10 shares of XYZ at a price of $10. XYZ goes up 20% to $12 and your equity increases by $20 (# of shares x change in price), but you do not realize (profit) the $20 until you sell. The biggest reason people have trouble selling is because of greed; they want more and more and more gains. Greed and emotion turns profits into losses. Learning how to properly sell helps ensure the preservations of gains and reduces the likelihood of incurring huge losses. Limit and Stop Orders reduce your loss exposure. A Limit Order is an order that sets the maximum and minimum at which you are willing to buy or sell. A Stop Order is an order to buy or sell once the price reaches a specified price. https://www.diffen.com/difference/Limit_Order_vs_Stop_Order Never attempt to time the market. Your goal is to buy at one price, and sell at a higher price.

0 Comments

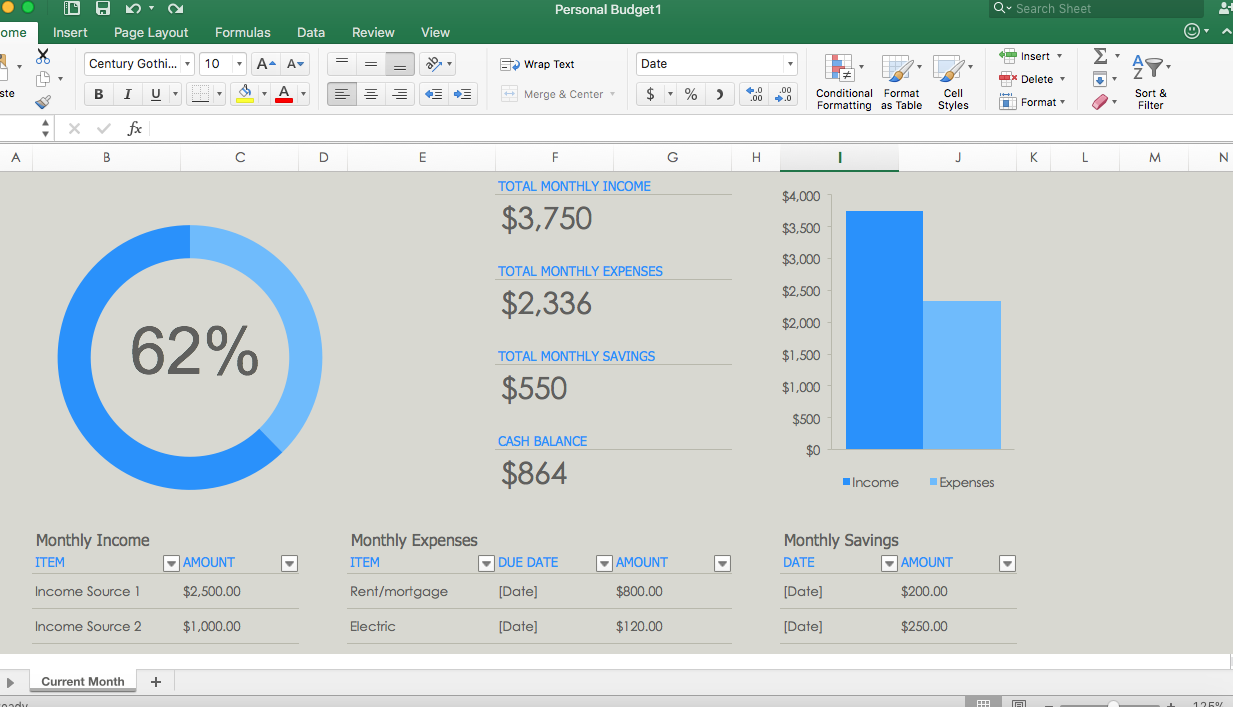

Budgeting is a great financial skill that will allow you to avoid debt, will keep you organized and up-tp-date with your expenses and income, and will help you build strong spending habits. A budget will help you plan for short-term expenses such as your monthly bills; mid-term expenses such as vacations; and long-term expenses such as buying a house, paying for a child’s college education or putting away money for retirement. A good budget can help keep your spending on track and even uncover some hidden cash flow problems that might free up even more money to put toward your other financial goals. You need to know where your money is going if you want to have a handle on your finances. The first step in planning a budget is to map out the sources of your income and where that money is going. Begin by listing your income, and list your expenses starting with the most important to the least important. The goal is to have your expenses be less than or equal to your income. If you have additional money after you plan your budget, you can add it to the categories for your financial goals like getting out of debt or building an emergency fund. If you have more expenses than income, you will need to find ways to cut back on your expenses. There are two ways to initiate a budget: you can either be more hands-on with your money or you can inactively track and manage your money. The actively tracking method consists of using an Excel budgeting template. You track every expense and income in monthly intervals. For every dollar you spend or make, you will use the Excel sheet to write it out. Focus on the “Income” and “Expenses” columns. Remembering and having the will to fill out the Excel sheet will take hard work and dedication, but with time, it will become natural. A tip is to collect your receipts. For every transaction you make, get the receipt and put them in a folder. Then instead of tracking your expenses per transaction, at the end of the month you can file through your receipts and list them once. Once you have mastered the art of budgeting, then you can start focusing on the “Savings” column. When your income is more than your expenses, you can start allocating that money into savings. It is important to save money for future expenses and worst scenario, if you lose your income source, you will have funds to support you until you find a new source of income. The second method is an inactive way of managing and tracking your money, and this involves using apps. These apps help keep track of your expenses and income for you and give you tips when they see irregular spending or when your expenses outweigh your income. A tip is to download all of them and test which ones work best for you. Some cost money, but some are also free. The hardest part of a budget is when your expenses are more than your income. Some ways to control this are: become more frugal with your spending, use coupons and look for price differences, cap your money at a certain amount each month, and use only cash. A budget is a powerful tool because it allows you to determine how and where you want to spend your money; every dollar is being used how you want it. Start budgeting today and you will see a huge difference in your finances.

Besides these rules, the experience of making mistakes and the practice of failing will teach you the true lessons of investing. I got introduced into stocks from my grandmother. I was always interested in finances and making money and with her, I was able to ask questions, receive real-world answers, and I was able to learn from her wisdom. Then, I received a book called "Stock Market Logic" by Norman G. Fosback from my grandfather. When reading it at a young age, it was very difficult to comprehend, and I only understood the basics of how nobody can consistently outperform the market and how everyone is the market. At the age of thirteen, I started trading stock. I remember begging my father to allow me to start trading. I showed him my research and I told him what stocks I wanted to invest in, and finally he gave in. A week later, I went with him to see our family stockbroker at Charles Schwab with a check written out for $2,000. Before we went into Nicollo's office, my father told me to sit there quietly and let him handle the business. My father handed Niccollo the check and told him that I wanted to add to my portfolio; the portfolio my parents and grandmother started for me when I was born. Then, Niccollo went on with advising us on stable, low-risk stocks that I should be investing in; turning his screen around to show us all of these graphs with an assortment of pretty colors and lines. (Back then, I did not know anything about trends and patterns so I was in a state of cluelessness). I pulled out my numbered list of stocks that I had created and handed it to him. Long story short, I invested in three companies that day with one of the investments being a recommendation by him: Amazon, Netflix, and Ford. As of February 15, 2018, Amazon has had a 327% unrealized gain, Netflix a 439% unrealized gain, and for Ford, besides their $.60 yearly dividend, I am currently at a loss. (Ford was the recommendation.) In high school, I gained access to my portfolio and I started to trade with permission from my parents. I was exposed to risk, gain, and loss and I was loving it. I had my apps where I was able to track stocks, make predictions, and view data, and I bought stocks from that research. When I turned eighteen, I opened up my own individual portfolio and I learned the hard lessons of day-trading. I used to wake up every weekday at 6am right before the market opened to submit my orders. I was so active in trading that once I placed multiple trades using the slow, limited-access WIFI in a bus station in Bratislava, Slovakia. I could not get enough and I was hypnotized on the idea of getting rich quick. Having this mindset caused me to make many mistakes which include:

The lessons to be learned are:

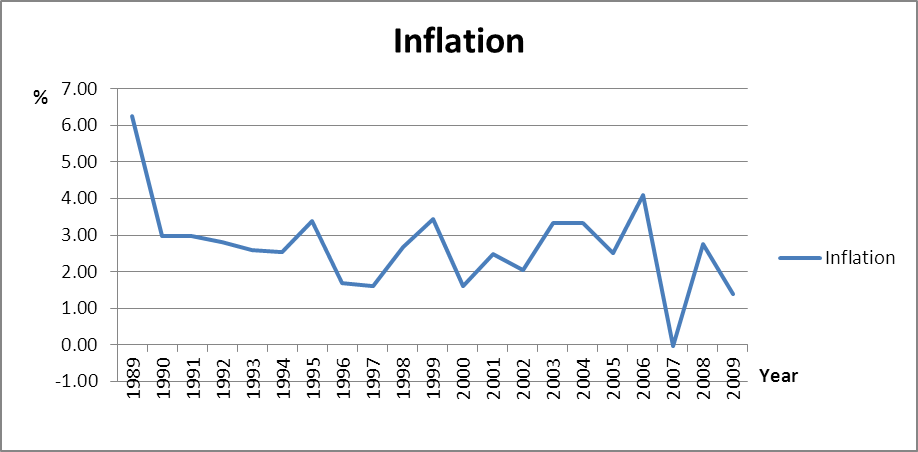

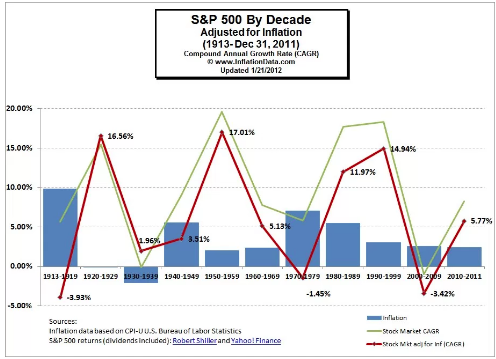

Inflation is the general increase in prices of goods and services.

https://commons.wikimedia.org/wiki/File:US_Inflation_rate.png

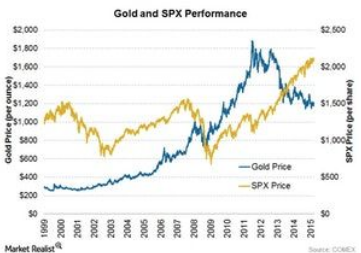

USD v GoldInverse relationship. A falling dollar increases the value of other countries’ currencies. This increases the demand for commodities including gold and it increases the price of gold. When the U.S. dollar starts to lose its value, investors look for alternative investment sources to store value. Gold is an alternative. Inflation v InterestInverse relationship. As interest rates are lowered, more people are able to borrow more money. The result is consumers have more money to spend, causing the economy to grow and inflation to increase. As interest rates are increased, consumers tend to save as returns from savings are higher. With less disposable income being spent as a result of the increase in the interest rate, the economy slows and inflation decreases. Stocks v Bonds Inverse relationship and correlated for special occasions. Stocks do well when the economy is booming; consumers are buying and companies have better earnings. Bonds do well when the economy is in decline, and investors prefer the guaranteed interest payments from bonds. At the top of the market when there is too much liquidity, investors are buying both bonds and stock and both rise. When investors have fear, they panic sell and bonds and stock both go down. Earnings drive stock prices and interest rates drive bond prices. DOW Jones vs Bonds: The bond market showed steady growth while the DOW suffered a significant loss. This lasted until the end of the recession. Bonds v GoldGold is generally viewed as an inflation hedge while bonds are viewed as a deflation hedge. Gold and bonds are both used by traders as a common safe-haven hedge. When volatility is high and stocks are behaving erratically, investors tend to flock to assets that hold their value better. A vote of no-confidence in the stock market can translate into a bullish rise for both Treasuries and gold prices. If the Federal Reserve takes action such as increasing the money supply through bond purchases, this will lift bond values as well, while sending investors a message that the economy may be weak – something that helps gold prices go higher. But interest rates are the real underlying fundamental force between gold prices and Treasuries. If inflation rises faster than the yield of the 10-year Treasury making real rates negative, then gold becomes a wealth preservation trade. It might not offer investors a yield, but it does protect against the devaluation of their money. In this kind of scenario, interest rates may rise along with inflation, but if real rates are still negative, then gold prices should rise along with them – while the price of bonds falls. Stocks v GoldCompletely inverse. Bonds v InterestInverse relationship. Bond prices fall as interest rates rise. As interest rates move up, the cost of borrowing becomes more expensive. This means that demand for lower-yield bonds will drop, causing their price to drop. As interest rates fall, it becomes easier to borrow money, and many companies will issue new bonds to finance expansion. This will cause the demand for higher-yielding bonds to increase, forcing bond prices higher. When the US economy is acting poorly, central bankers tend to lower interest rates to help stimulate growth. As interest rates go down, bond prices go up. Stocks v Interest Inverse relationship. When interest rates are rising, both businesses and consumers will cut back on spending. This will cause earnings to fall and stock prices to drop. On the other hand, when interest rates have fallen significantly, consumers and businesses will increase spending, causing stock prices to rise. Stocks v InflationStudies have produced conflicting results when several factors are taken into account, namely geography and time period. If all commodities are going up stocks would probably go up as well, since companies produce commodities. But that isn’t always the case. Often high inflation can actually squeeze profit margins and cause companies to lose money or barely break even. Bonds v Inflation The first effect is that rising inflation can cause the U.S. Federal Reserve to raise short-term interest rates in order to reduce the demand for credit and help prevent the economy from overheating.When the Fed raises short-term rates, longer-term rates also tend to go up. Since bond prices and yields move in opposite directions, rising yields mean falling prices—and a lower principal value for your fixed-income investment. Raising inflation rates also take a huge chunk out of the value since the inflation is likely to overshadow the growth of the bond.

Lenders use the FICO score when deciding whether or not to approve you for a loan or new line of credit. There are many factors that affect your credit score.

These include:

When you have a low credit score from owning too much debt or from other factors hurting your credit, it is hard for you to apply for loans or become creditworthy. Here are tips on how you can raise your credit score:

|

AuthorMy name is Camden Alchanati and my goal is to teach you how to create a future of financial stability and growth! Archives

June 2020

|

|

Phone: (323)-553-2411

|

|

All information stated does not represent The ACA Foundation's opinions and we do not claim responsibility for most of the content. This website does not provide individual or customized legal, tax, accounting, or investment advise.

All Rights Reserved

All Rights Reserved

RSS Feed

RSS Feed