|

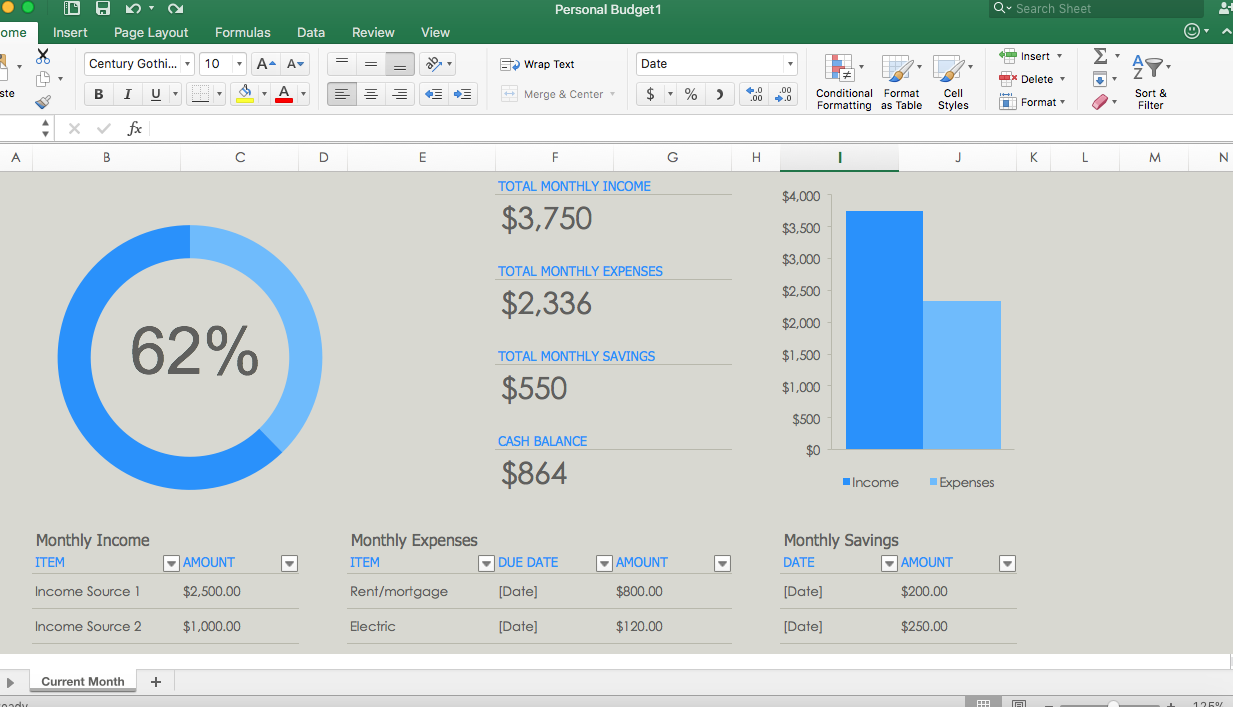

Budgeting is a great financial skill that will allow you to avoid debt, will keep you organized and up-tp-date with your expenses and income, and will help you build strong spending habits. A budget will help you plan for short-term expenses such as your monthly bills; mid-term expenses such as vacations; and long-term expenses such as buying a house, paying for a child’s college education or putting away money for retirement. A good budget can help keep your spending on track and even uncover some hidden cash flow problems that might free up even more money to put toward your other financial goals. You need to know where your money is going if you want to have a handle on your finances. The first step in planning a budget is to map out the sources of your income and where that money is going. Begin by listing your income, and list your expenses starting with the most important to the least important. The goal is to have your expenses be less than or equal to your income. If you have additional money after you plan your budget, you can add it to the categories for your financial goals like getting out of debt or building an emergency fund. If you have more expenses than income, you will need to find ways to cut back on your expenses. There are two ways to initiate a budget: you can either be more hands-on with your money or you can inactively track and manage your money. The actively tracking method consists of using an Excel budgeting template. You track every expense and income in monthly intervals. For every dollar you spend or make, you will use the Excel sheet to write it out. Focus on the “Income” and “Expenses” columns. Remembering and having the will to fill out the Excel sheet will take hard work and dedication, but with time, it will become natural. A tip is to collect your receipts. For every transaction you make, get the receipt and put them in a folder. Then instead of tracking your expenses per transaction, at the end of the month you can file through your receipts and list them once. Once you have mastered the art of budgeting, then you can start focusing on the “Savings” column. When your income is more than your expenses, you can start allocating that money into savings. It is important to save money for future expenses and worst scenario, if you lose your income source, you will have funds to support you until you find a new source of income. The second method is an inactive way of managing and tracking your money, and this involves using apps. These apps help keep track of your expenses and income for you and give you tips when they see irregular spending or when your expenses outweigh your income. A tip is to download all of them and test which ones work best for you. Some cost money, but some are also free. The hardest part of a budget is when your expenses are more than your income. Some ways to control this are: become more frugal with your spending, use coupons and look for price differences, cap your money at a certain amount each month, and use only cash. A budget is a powerful tool because it allows you to determine how and where you want to spend your money; every dollar is being used how you want it. Start budgeting today and you will see a huge difference in your finances.

1 Comment

|

AuthorMy name is Camden Alchanati and my goal is to teach you how to create a future of financial stability and growth! Archives

June 2020

|

|

Phone: (323)-553-2411

|

|

All information stated does not represent The ACA Foundation's opinions and we do not claim responsibility for most of the content. This website does not provide individual or customized legal, tax, accounting, or investment advise.

All Rights Reserved

All Rights Reserved

RSS Feed

RSS Feed