|

A recession is a period of economic decline that can hurt the livelihood of millions and by having many recessions throughout history, indicators were found to predict when recessions would occur. The most significant indicators of a recession are:

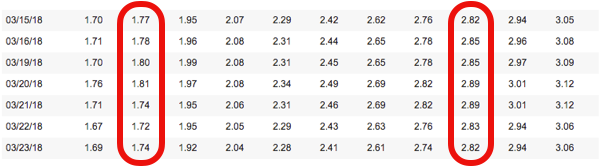

I will only discuss the first one. https://www.treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=yield This is a daily chart of the treasury yield curve rates. The first highlighted box going from left to right are the 3 month interest rates and the second highlighted box are the 10 year interest rates. A negative spread between 10 year T-bonds and 3 month T-bonds means that if the 3 month rates are greater than the 10 year rates, it creates a negative spread and could trigger an economic downturn.

0 Comments

The Federal Reserve was created to help reduce the velocity and magnitude of an economic downturn. In 1913, the Federal Reserve was originally formed to prevent the money supply and credit from drying up during recessions. One of the biggest tools the Feds have is the ability to loan millions or billions or even trillions of dollars to banks that would then be induced to lend more money. The Federal Reserve's top duties today are to manage the bank reserves and money supply to allow the economy to expand securely. They fulfill these duties by changing reserve requirements (when needed), change the discount rate (when needed), and perform open market operations like buying and selling government securities. The Federal Reserve has a vital role in the US economy. When the economy is in a downturn, the Feds increase the supply of money to spur growth. When inflation is threatening, the Feds reduce the threat by shrinking the supply. By the Feds managing money supply, they are able to control the economy and help the U.S. go through the business cycle successful.

|

AuthorMy name is Camden Alchanati and my goal is to teach you how to create a future of financial stability and growth! Archives

June 2020

|

|

Phone: (323)-553-2411

|

|

All information stated does not represent The ACA Foundation's opinions and we do not claim responsibility for most of the content. This website does not provide individual or customized legal, tax, accounting, or investment advise.

All Rights Reserved

All Rights Reserved

RSS Feed

RSS Feed