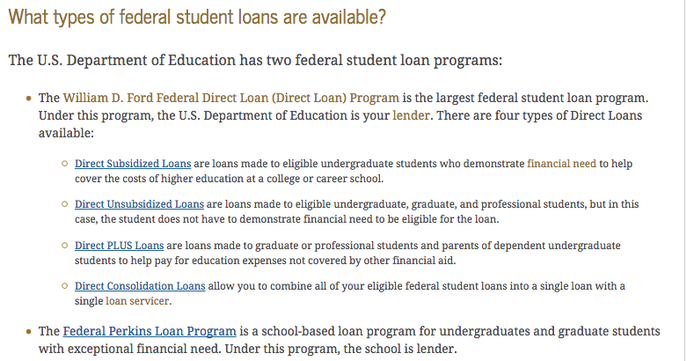

What is a Loan?Money you borrow with interest that you need to pay back. What are Student Loans?A type of loan designed to help students pay for schooling and expenses related to schooling. Two Types of Federal Student Loans

https://studentaid.ed.gov/sa/types/loans#types Tips On How to Pay Off Student Loans Faster

Common Mistakes

How to Avoid a Loan Scam1. Avoid Upfront Payments 2. Be Wary of Aggressive Sales Pitches 3. Don't Give Out Your Personal Info 4. Do Your Research Report being scammed to the CFPB, the Federal Trade Commission (FTC) and your state attorney general's office. ResourcesStudent Loan Refinancing and Consolidation Cheat Sheet

https://studentloanhero.com/student-loan-refinancing-cheat-sheet/?utm_source=automationemail&utm_medium=email&utm_campaign=refi-refiautomation&utm_content=ba-email1 Student Loans 101 https://myfedloan.org/borrowers/student-loans-101/ Is the Government Making Money off of Your Student Loans? http://money.cnn.com/2016/08/04/pf/college/federal-student-loan-profit/index.html?iid=EL Student Loan Basics https://www.discover.com/student-loans/college-planning/loans-101.html Don’t Be Fooled By Student Debt Relief Scams http://money.cnn.com/2016/08/16/pf/college/student-debt-relief-scams/index.html?iid=ELStudent Loan Refinancing and Consolidation Cheat Sheet https://studentloanhero.com/student-loan-refinancing-cheat-sheet/?utm_source=automationemail&utm_medium=email&utm_campaign=refi-refiautomation&utm_content=ba-email1 Student Loans 101 https://myfedloan.org/borrowers/student-loans-101/ Is the Government Making Money off of Your Student Loans? http://money.cnn.com/2016/08/04/pf/college/federal-student-loan-profit/index.html?iid=EL Student Loan Basics https://www.discover.com/student-loans/college-planning/loans-101.html Don’t Be Fooled By Student Debt Relief Scams http://money.cnn.com/2016/08/16/pf/college/student-debt-relief-scams/index.html?iid=EL

0 Comments

Leave a Reply. |

AuthorMy name is Camden Alchanati and my goal is to teach you how to create a future of financial stability and growth! Archives

June 2020

|

|

Phone: (323)-553-2411

|

|

All information stated does not represent The ACA Foundation's opinions and we do not claim responsibility for most of the content. This website does not provide individual or customized legal, tax, accounting, or investment advise.

All Rights Reserved

All Rights Reserved

RSS Feed

RSS Feed