0 Comments

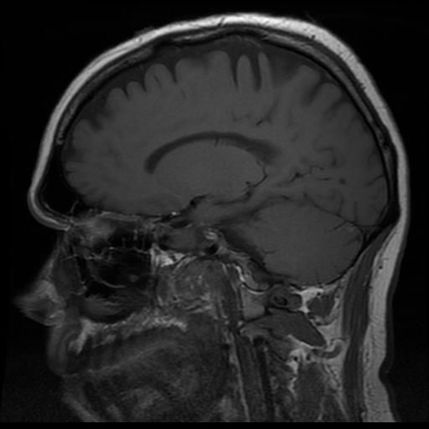

●Intrinsic Valuation- The value of a company determined by fundamental analysis ●DCF- The sum of all the cash flows it will generate, discounted to the present value at a rate that reflects the riskiness of the cash flows ●Discount Rate- The required rate of return for the investors and is a function of the riskiness of the cash flows ●How to get Free Cash Flow- ○Revenue ○(COGS) ○(Operating Expenses) ○(Interest and Tax) ○Net Income ○Cash Flow From Operations: Net Income - Change in Working Capital ○FCF: Cash Flow From Operations - CapEx ●Forecasting Cash Flow Statement ○Working capital is usually a fixed percentage of revenue ○CapEx/revenue: take the average of that and that is how you will forecast the rest of Cap Ex ○Depr. and Amort/revenue: percentage and use it to forecast D&A into the future ●WACC- Cost of raising new capital ○WAAC = discount rate ■Discount rate = risk

One of the keys to life is knowing what to buy and how to sell. We are always selling: selling ourselves, our words, our personal experiences, our knowledge, our products and services... Marketing might seem like an easy concept to do, but it incorporates behavioral science, cognitive science, microeconomics (preference, how to control supply and maximize demand, choice, necessity, scarcity and uniqueness/originality), writing, creativity, graphic design, and much more. You can still try and go out, prospect, cold call, go door-to-door and pitch your idea, but without a little background in marketing, it will not guarantee you success. First you need to find out what your market wants, needs and likes. You need to appeal to their lifestyle, their perceptions, their preferences, their spending triggers, etc. Then you need to create a brand: become well-known (build up your reputation) by using popularity, aroma, appeal, social media, influencers, creating buzz, color, uniqueness, creativity, etc. Lastly, you need to find the best outlet of exposure to reach your targeted market. Print, mainstream media, online, social media, billboards, outdoor advertising, etc. Marketing success is based on: how much coverage is created, number of viewers, attendance of events, the number of clients that you make happy, increase in market share/increase in sales for clients…

Compass Financial Advisors

Compass Financial Advisors

Compass Financial Advisors

• Your whole experience of existence is really whats going on in your mind • All of our emotions are created by our thoughts • Most of your interpretations are not particularly true • People distract themselves because they cannot live with their minds • The healing is only going to come once you change the perspective of the pain • Suffering is your mind not dealing with the feeling in a positive way • “I feel really lonely and that’s okay” • “It’s for the best” • Growth comes from pain and challenge • Find the meaning in the pain • Your whole life is your attitude towards life • “I’ll change my thoughts to change my emotions” • To get rid of the pain, take away the thinking • Thoughts • Is it true or not? Is it serving any purpose? Is it going to help me? • Acknowledge it and then replace it with positivity • Write down negative thoughts that come to you and number them. You will be more aware when they come • “That’s not who I am anymore, I don’t do that” • Choose your thoughts and replace it with something good • I’m holding onto a rope that’s not attached to anything. Let go, feel the pain, accept that this connection is no longer in service. • Say whatever is wrong, accept that it’s wrong, and then say “and it’s okay” • “I feel really lonely and that’s okay” • “What’s your perspective and attitude towards life?” • EMUNA: I know everything in my life is there to test me and make me better and stronger Here is a list of money management tips and tricks to insure that your money and wealth grows:

Sourced by KW Kids Can, Inc. and Rellek Publishing Partners, Ltd.

|

AuthorMy name is Camden Alchanati and my goal is to teach you how to create a future of financial stability and growth! Archives

June 2020

|

||||||

|

Phone: (323)-553-2411

|

|

All information stated does not represent The ACA Foundation's opinions and we do not claim responsibility for most of the content. This website does not provide individual or customized legal, tax, accounting, or investment advise.

All Rights Reserved

All Rights Reserved

RSS Feed

RSS Feed